It is a goal to help wherever I can and get out of the way when I can’t. Helping to recruit and build teams is one way I can do something other than write a check. I am sure a lot of venture investors do a better job than I do, but all the great ones I think make it a priority.

I try really hard as a venture investor to really help. I view it as critical to my ultimate success as a venture investor at least for the long game. Sometimes I do better than other times – though always paying attention to do no harm which I wrote about in a prior post on the (venture) hippocratic oath. Sometimes there is little I can do. For example, I can’t really help define a product or even dissect the friction in a sales process besides sharing stories of past experiences.

But over the years one area that I have found I can help a lot with hiring executives for the portfolio companies and spending time with employees that are trying to think through career decisions. Some might argue its not a great use of my time – and time it is – probably something like 10-20% in any given week. But I have come to the conclusion that at least for me, it is one way to provide some leverage for the portfolio companies. Its not altruistic – the reality is that with great teams my job as a venture investor is greatly simplified. As a result, helping to build and support those teams is a very good use of time and if I help its truly constructive to building the business – like introducing the company to a new customer.

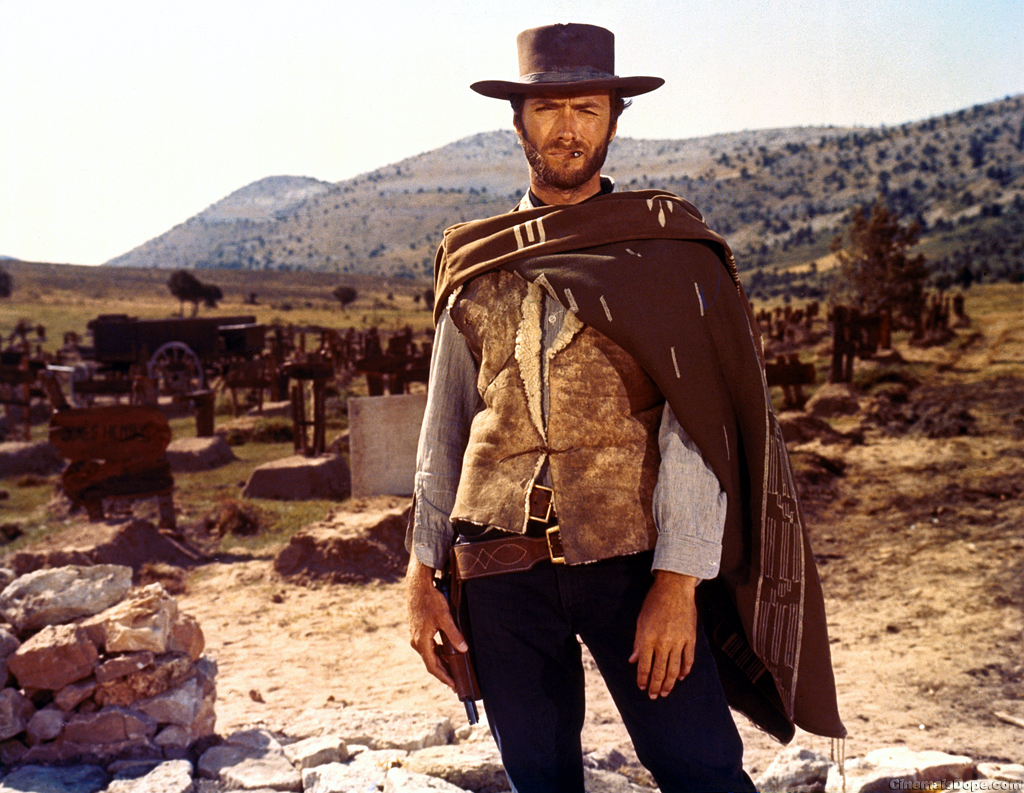

So why the Good, the Bad and the Ugly? On this point I may differ from others in a material way. I try to give a full picture of the company. I assume that everyone I am meeting is smart. It drove me crazy when I was younger listening to venture investors spew mindless optimism about their companies. Most venture investors I know are loose with the facts. It does take eternal optimism to survive day to day in the venture business so its not all that surprising. I remember feeling like I was being treated like a second grader when I was leaving my last operating role. I couldn’t believe that people thought I had no other context for the opportunities – and generally those conversations made me want to run from the company because I assumed that this was how the investors (or CEOs) thought about the world. Who wants to work for someone who is delusional? I know that smart people will eventually discover all the challenges of any company (and every company has them) so better to discuss them in the process as it relates to fit and avoid surprises. I know of a recent situation where an executive was recruited into a company having been sold on certain sales numbers and customer contracts. The reality when he got there was that none of it was true. He left and everyone lost. Its not a unique situation.

One of the hardest parts in hiring, recruiting and retaining the best people is to balance giving a different perspective as an investor but at the same time do my best to act just like anyone else on the executive team – because ultimately its not my decision who we hire and who we don’t at a company. There are some situations where I have a strong opinion on someone but I try hard to not cross that imaginary line where a CEO or VP might think it would be a mistake to hire someone simply based on my view. I need to respect the relationship. You cannot help if being critical is the only club in your bag.

I am fortunate in that most of the time when I am interviewing potential hires, I am not the initial screen so the people I am meeting are generally somewhat qualified at least on paper. Most of the time I am focused on fit – is the company the right place for the new hire in the role that they have in mind (scope, experience etc.) and does the role fit the career path and match against the passion of the individual. I have found this is a great way to get into the detail without the grind of typical interview questions. I have different discussions with different roles and I do have some basic questions like if I am talking with a VP Sales I want to understand how they have built teams, what sort of quota they carried, deal size etc. But I find this is a natural conversation for the pros. They never hesitate and its an easy discussion. As a venture investor, I can offer up a different perspective as an investor – why I invested, what has worked, what hasn’t worked, how I think about the market etc.

Every company has issues. Its much better to put them out in the open and have everyone join the company with their eyes wide open. That way, while things may still not work out, it won’t be because expectations were not in line with reality. I think it makes a stronger case for the company and treats everyone like a professional – which all ultimately lead to a better outcome.